US electric vehicle market with high automaker concentration

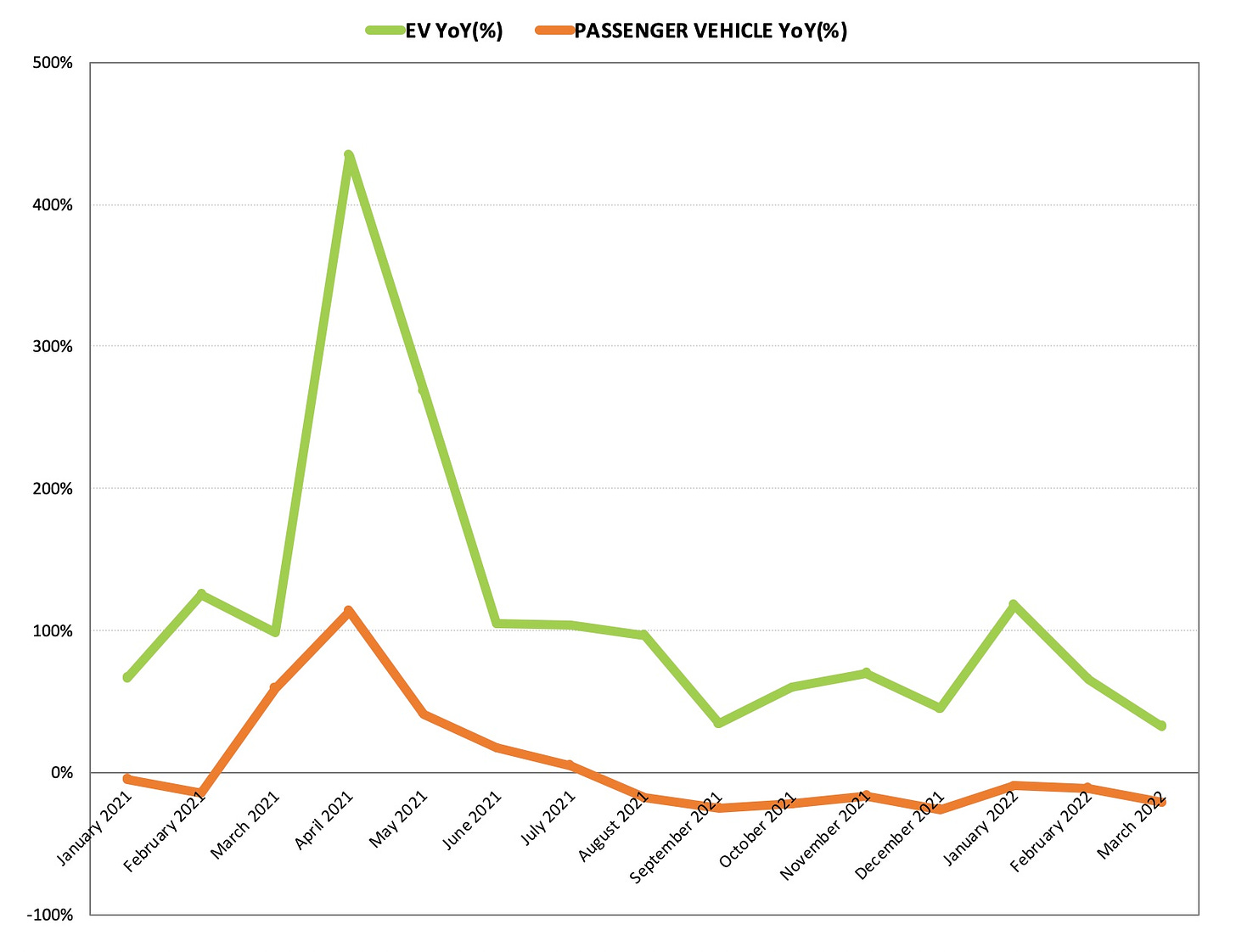

Since the outbreak of Covid 19 in the first quarter of 2020, the global auto market has continued to face the impact of supply chain constraints, and the Russian invasion of Ukraine and inflation have exacerbated supply chain risks this year. The United States, the world's second-largest auto market after China, has undoubtedly been affected, with its passenger vehicle market showing negative growth year-over-year in all but five months from March to July 2021. In contrast, the annual growth rate of the US electric vehicle (EV) market outperformed the overall auto market by a wide margin, as shown in figure 1.

Figure 1 Monthly annual growth rates for EV and passenger vehicle in the US

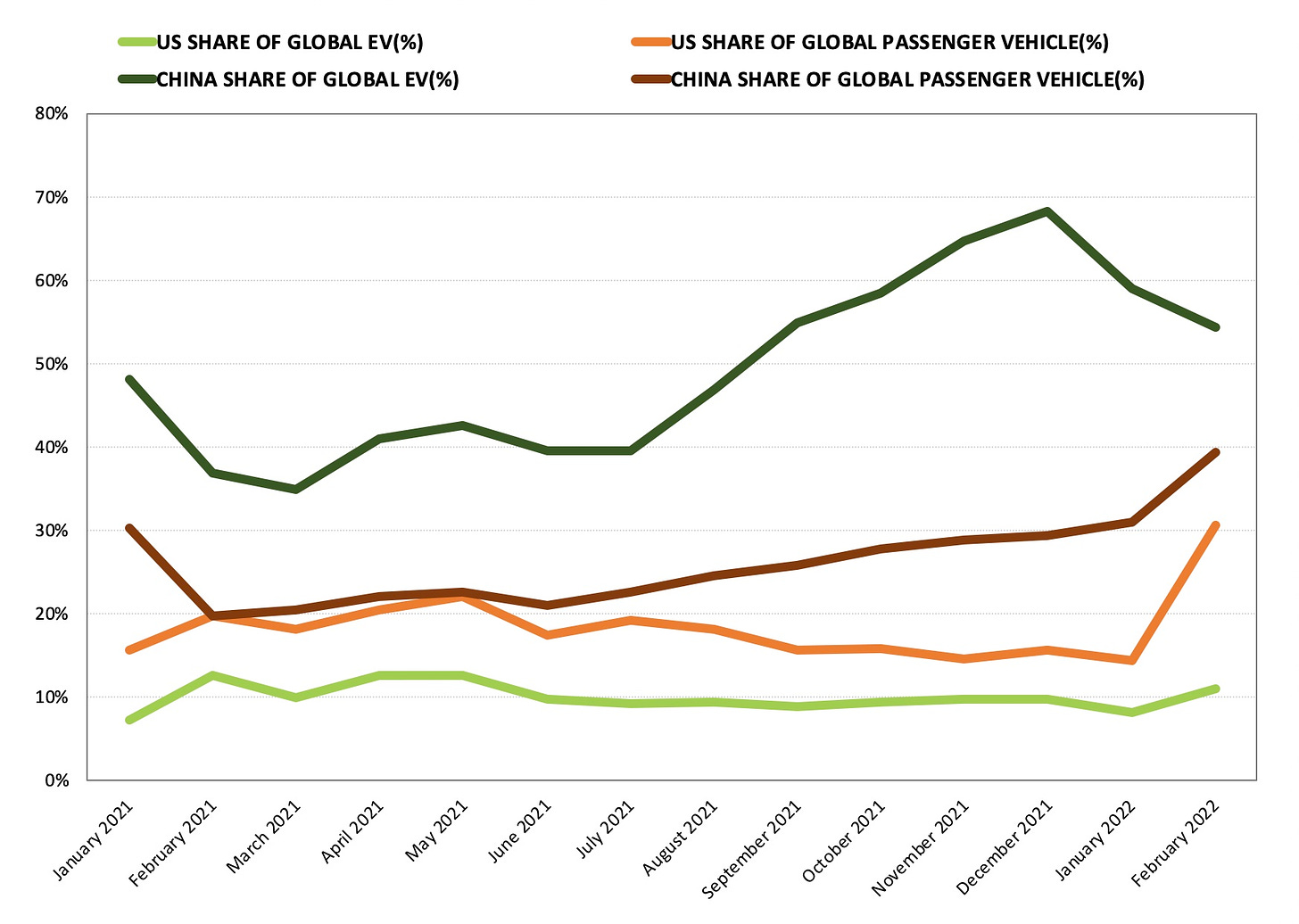

The US EV market is the second-largest globally, but its size is far smaller than that of China. For example, in February this year, the Chinese market accounted for 39.3% of the global passenger vehicle market, while the US accounted for 30.7%. Still, China accounted for 54.3% of the worldwide EV market, while the US only accounted for 11.0%, as shown in figure 2.

Figure 2 Monthly market share changes of the US and China in the global passenger vehicle and EV

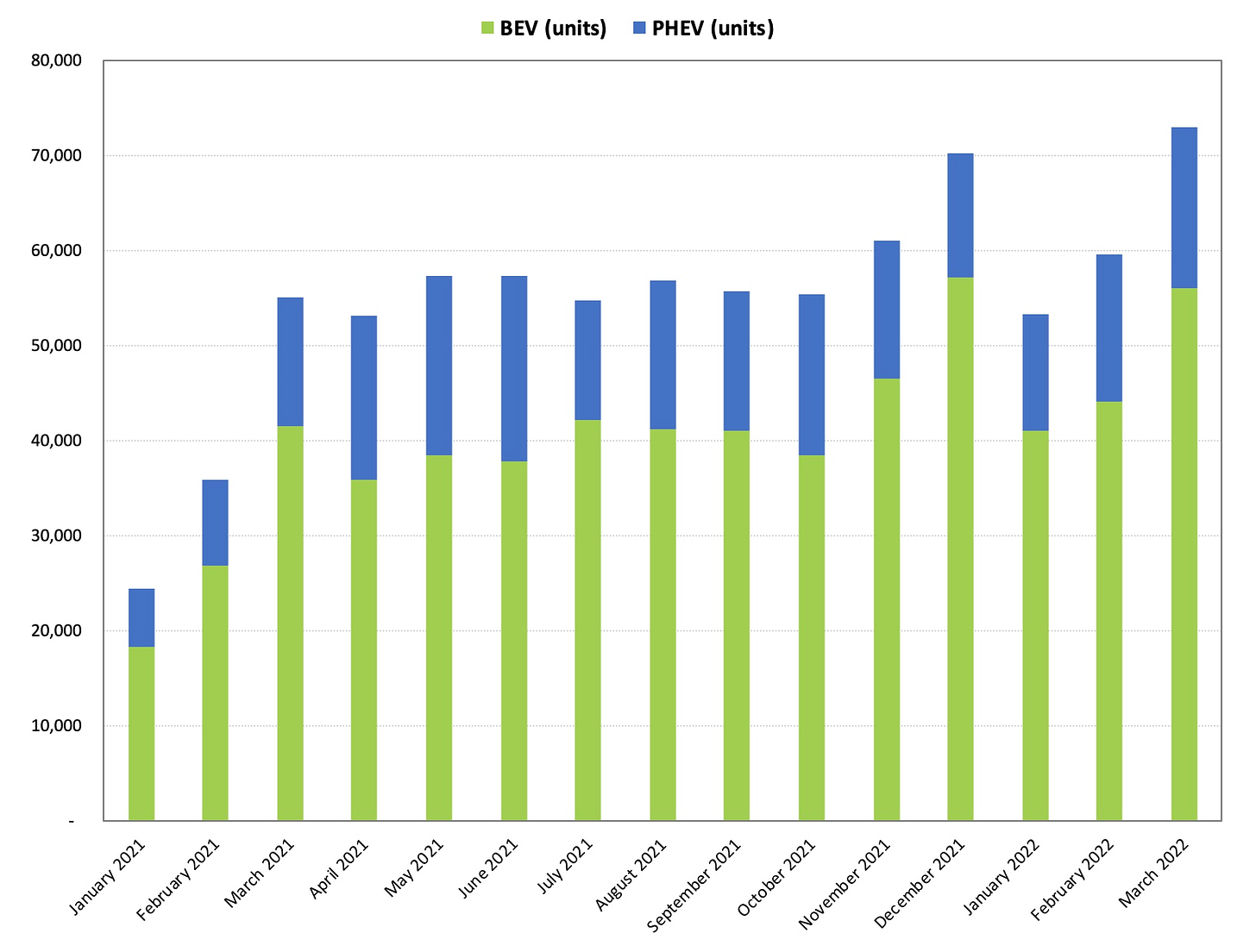

The main reason for this is the low penetration of EV in the US, and it is the lowest among the top 10 EV sales countries in the world. However, because of the administration's positive stance on EV subsidies and supporting measures, the growth of the US EV market this year is quite promising. For example, the sales in January and February this year remained at the same level as the second half of last year, and the March sales hit a record high of 72,955 units, indicating that demand in the US market remains strong, as shown in figure 3.

Figure 3 US Monthly EV sales by type

There were 57 models in the US EV market, and they were mainly battery electric vehicle (BEV). In terms of sales, the concentration of models in the US EV market was relatively high, and the market share was mainly concentrated in the top 10 EV OEMs. For example, in February this year, only 29 models had sales of more than 200 units, only 13 models had more than 1,000 units, and the top 10 EV OEMs accounted for 98.1% of the market, as shown in figure 4.

Figure 4 Monthly market share changes of EV OEMs in the US EV market

Among the top 10 EV OEMs, Tesla has consistently ranked first in market share. Although its monthly sales share fluctuated, it remained above 60% for three consecutive months since December 2021. Besides, Tesla Model Y and Model 3 also ranked first and second in the US. Next was Hyundai Motor, whose market share unexpectedly surpassed that of Toyota Motor in February due to the hot sales of Ioniq 5, Kia EV6, and Kia Niro, resulting in a swap in rankings between the two.

Compared with the sales performance in February last year, Tesla, Hyundai Motor, Volvo Cars, and Stellantis all saw their market share increase while Toyota Motor, Ford, VW Group, BMW Group, and GM lost market share. Among them, Tesla was the automaker with the most significant market share growth, from 53.3% in February last year to 61.4% in the same period this year, followed by Hyundai Motor, from 3.8% to 10.9%; Ford, on the other hand, was the automaker with the largest market share decline, from 10.9% to 4.0%, followed by GM, which fell from 5.6% to 0.1%.

Regarding the future development of the US EV market, we believe that proactive policy action is the key to driving future growth. Although the global EV market continues to be deeply influenced by the global supply chain, which not only limits the growth of EV supply but also drives up EV prices, the overall demand for EV remains strong despite these negative factors, and the US market is no exception. Therefore, we believe its EV market will grow steadily from quarter to quarter.