The proportion of LFP battery in electric vehicle will continue to hit record highs in 2022

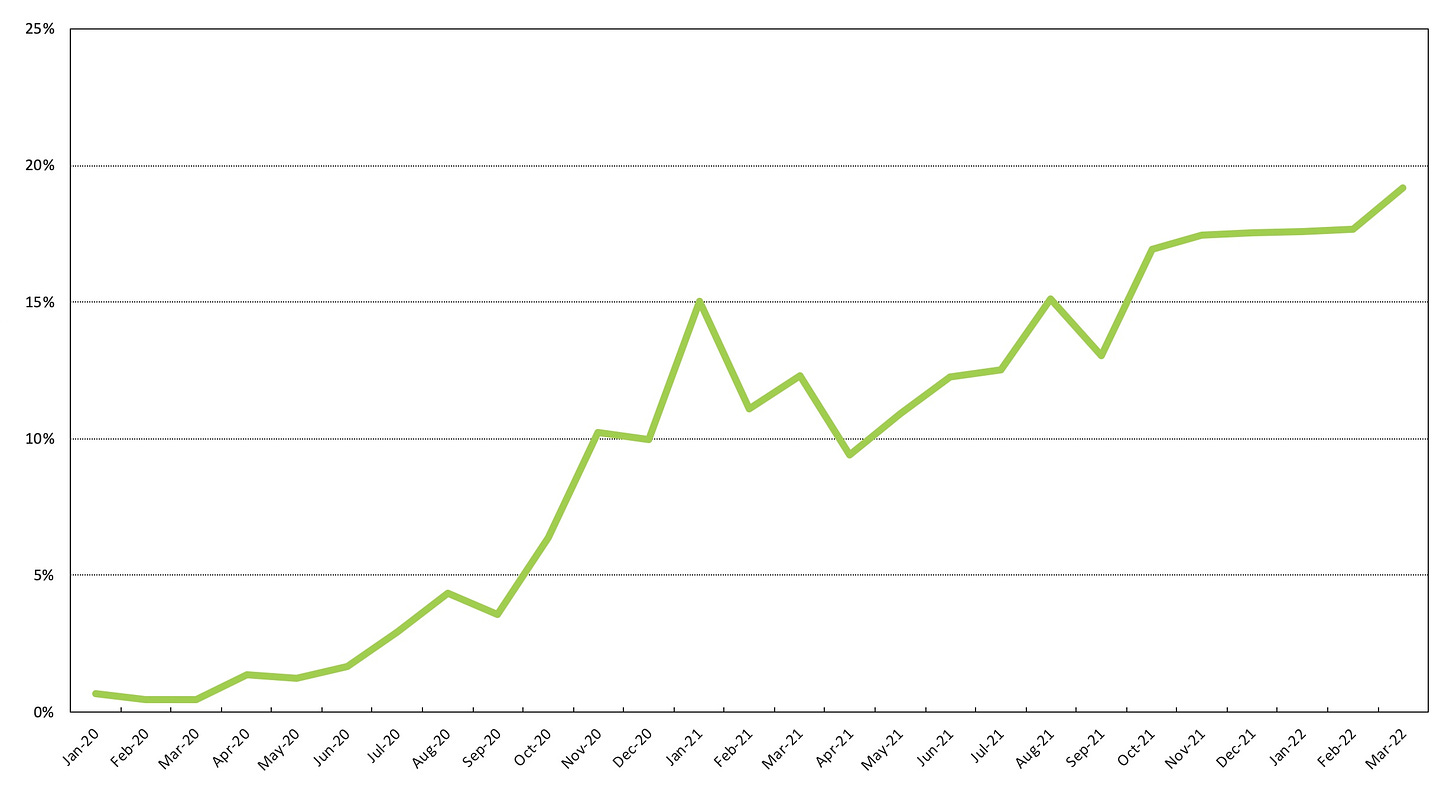

According to Researcher and Research LLC, a new high share of lithium-iron-phosphate (LFP) battery in global electric vehicle (EV) market (in terms of MWh) was 19.2% in March 2022, as shown in figure 1. We expect the share of EV using LFP battery continues to reach new highs this year, mainly driven by sales from Tesla, BYD, GM (Wuling), Chery, GreatWall, XPeng and etc.

Figures 1 Share (MWh) of LFP battery in global EV market

Most of EV models using LFP battery were manufactured and sold in the Chinese market last year, and the share of LFP battery in the Chinese EV market has challenged the dominance of ternary lithium battery such as nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA). With the successive shipments of some of Tesla’s models equipped with LFP battery, LFP battery has entered the global market.

The performance of early LFP battery was seriously behind that of NMC and NCA batteries. As a result, only Chinese battery manufacturers produce LFP battery, and they were all used in the e-bike and low-end EV markets. It was not until that the demand for LFP battery gradually became stronger, mainly due to the relatively mature development of BYD's blade battery and CATL's cell-to-pack (CTP) technology, allowing LFP battery to improve energy density and significantly reduce range anxiety. Moreover, corresponding solutions for the decrease of range caused by low temperature environment have also emerged.

Currently, only Chinese battery manufacturers dominate LFP battery market. As for major battery manufacturers outside China, such as Japanese and South Korean makers, still focus on the production of NMC, NCA and etc. They are not interested in producing LFP battery for EV, because they consider the profit is too low and the recycling value is low as well. However, in addition to existing battery manufactures, a few battery startups have proposed to produce LFP battery in Europe.

Although the energy density is lower than that of NMC and NCA batteries, LFP battery has relatively low cost because of their long battery life and excluding scarce raw materials, such as nickel and cobalt. In this regard, we can see more and more EVs using LFP battery to achieve the goal of increasing market size at a lower price. Examples of significant growth in sales of such models include: (1)GM Wuling HongGuang Mini; (2)Tesla Model 3 and Model Y; (3)Full range of BYD EV models with its own battery cells; (4)Chery QQ, (5) Changan Benni E-Star, (6)Great Wall Good Cat; (7)Hozon Nezha V, (8)GAC Aion Y, and (9)Xpeng G3, P5 and P7.

Although a critical shortage of battery metals for EV has comprehensively impacted the capacity planning of battery manufacturers and shipment schedule of EV OEMs, the ability to significantly reduce the cost of EV battery is still the key to stimulate the growth of market demand in these years. Moreover, under the dual consideration of cost and safety, the incentive for automakers to choose LFP battery at present is even stronger. Ford, VW Group and Stellantis have also publicly stated that they will use LFP battery in commercial and entry-level models. Thus the proportion of LFP battery used in EV will continue to rise in the future.

The proportion of EV equipped with LFP battery in 2021 was 14.3% (in terms of MWh) , a significant increase from 5.2% in 2020. Under the pressure of price hikes of battery supply chain this year, we rose our estimate for the proportion of LFP battery from 20.6% to 21.5% this year, as shown in figure 2, and we do not rule out the possibility of revising our estimate upwards later this year.

Figures 2 Shares (MWh) of global EV battery by type, 2020-2030

We expect more and more EV OEMs to launch models with LFP batteries in 2023 and 2024, so the share will continue growing until gaining most of the market for low- and mid-priced EV models. On the other hand, ternary lithium battery like NMC and NCA has superior energy density, along with the trend of high-nickel will highlight its advantages of fast charging and long range. In addition, the battery has high value of mineral resources recycling, and it can realize closed loop, which is strongly recognized by the European and US governments.

In the long term, we expect LFP battery to win the low- to mid-priced EV market, sodium-ion battery will be the main competitor for LFP battery in low-priced EV models, solid-state battery will focus on high-priced EV models, while ternary battery such as NMC/NCA will stick to the mid- to high-priced market.

Note:

Researcher and Research LLC here defines EV as battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV), with passenger car as the primary purpose.

Please note that there will be no update of the Global EV Snapshot next week (May 6) due to our regular brainstorming meetings. We will publish the next article on May 13. Thanks for your understanding and have a nice weekend!